-EP1193.jpg?M4D_bMXdZqOtjX968lbhon6J9Vm2CVir&itok=pnyEHj2Q)

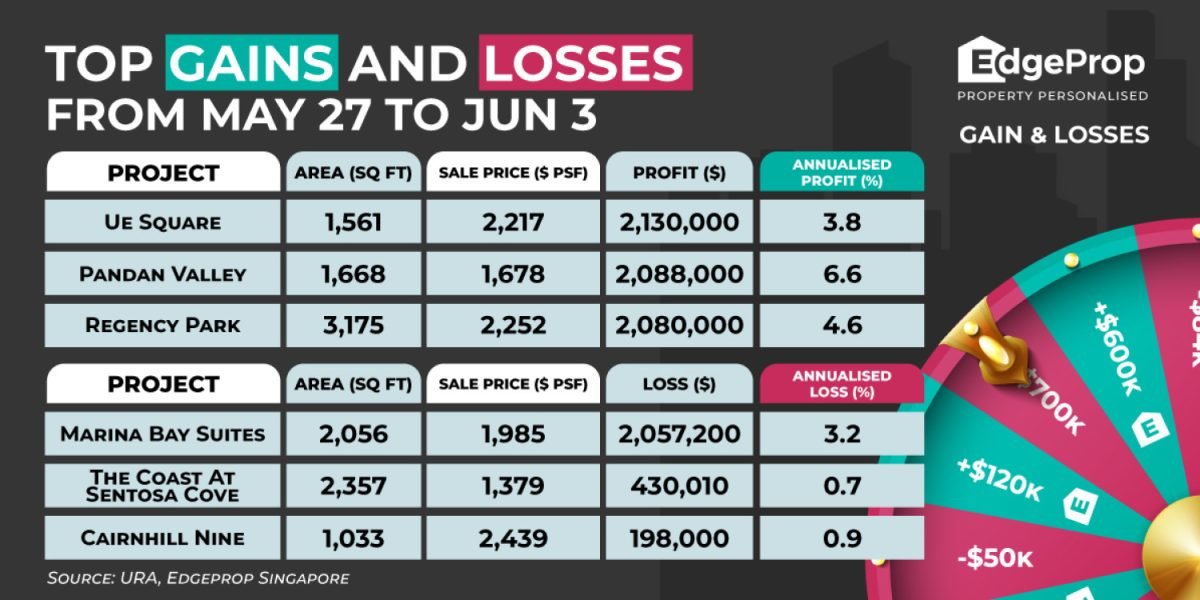

The sale of a three-bedroom unit at UE Square was the most profitable transaction during the week of May 27 to June 3. The 1,561 sq ft apartment on the 12th floor fetched $3.46 million ($2,217 psf) on May 29. The unit had been bought for $1.33 million ($852 psf) in July 1999. As a result, the seller made a profit of $2.13 million (160.2%), which translates to an annualised gain of 3.8% over nearly 26 years.

UE Square is a 929-year leasehold condominium on River Valley Road in prime District 9. Completed in 1997, the 495-unit development features a mix of one- to five-bedroom units of 506 sq ft to 3,089 sq ft.

A 1,561 sq ft unit at UE Square netted a record gain of $2.13 million when it was sold for $3.46 million on May 29. (Photo: Samuel Isaac Chua/The Edge Singapore)

Based on lodged caveats, the deal on May 29 is the third most profitable deal to date at UE Square. It falls about $50,000 short of the development’s record gain of $2.18 million, which was set when a 3,089 sq ft, four-bedroom unit on the 18th floor transacted for $6.27 million ($2,031 psf) in October 2023. The seller, who purchased the unit for $4.1 million ($1,327 psf) in 2009, walked away with an annualised gain of 3.1% after holding the unit for over 13 years.

Seven transactions have been recorded at the development this year, four of which were profitable, including the unit sold on May 29. This year, the current average resale price for UE Square stands at $2,084 psf.

The second most profitable resale during the week took place at Pandan Valley. A 1,668 sq ft, three-bedroom unit on the eighth floor fetched $2.8 million ($1,678 psf) on May 31. It was previously purchased by the seller in February 2004 for $712,236 ($427 psf). Hence, the seller netted a gain of $2.09 million (293.3%) after holding the unit for over 21 years.

This is the ninth most profitable condo resale transaction recorded at Pandan Valley. The most profitable deal was the sale of a 5,974 sq ft, four-bedroom apartment in April last year. The seller had bought the unit in October 2000 for $1.73 million ($290 psf) and later sold it for $5.4 million ($904 psf). Thus, the seller reaped a profit of $3.67 million, or an annualised profit of 5%, after owning the unit for almost 24 years.

A 1,668 sq ft, three-bedroom unit at Pandan Valley changed hands for $2.8 million on May 31, recording a gain of $2.09 million. (Photo: Samuel Isaac Chua/The Edge Singapore)

Pandan Valley is a freehold condo located along the street of the same name, just off Ulu Pandan Road in District 21. Completed in 1978, the development spans over 865,000 sq ft and comprises multiple blocks with a total of 605 units. The development offers a mix of two- to five-bedroom apartments, ranging between 1,173 sq ft and 6,867 sq ft.

On the other end of the spectrum, Marina Bay Suites saw the least profitable condo resale transaction during the week. A four-bedder spanning 2,056 sq ft on the 53rd floor was sold for $4.08 million ($1,985 psf) on June 2. The seller had acquired the unit in December 2012 for $6.14 million ($2,985 psf). Hence, they incurred a loss of $2.06 million or 33.5% after holding the unit for over 12 years.

A four-bedroom apartment at Marina Bay Suites was sold for $$4.08 million on June 2, resulting in a loss of $2.06 million. (Photo: Samuel Isaac Chua/The Edge Singapore)

Marina Bay Suites is a 99-year leasehold development on Central Boulevard in the Marina Bay financial district. Completed in 2013, the 221-unit development comprises only three- and four-bedroom apartments, spanning 1,572 sq ft to 2,691 sq ft.

There have been five resale transactions at Marina Bay Suites this year, all of which were unprofitable. The smallest deal by absolute value involved a 1,625 sq ft, three-bedroom unit on the 58th floor that was sold for $3.1 million ($1,907 psf) on Jan 24. Other resale transactions this year have ranged from $3.2 million ($1,969 psf) for a 1,625 unit sold on Jan 24 to $4.21 million ($2,036 psf) for a 2,067 sq ft unit sold on April 3.