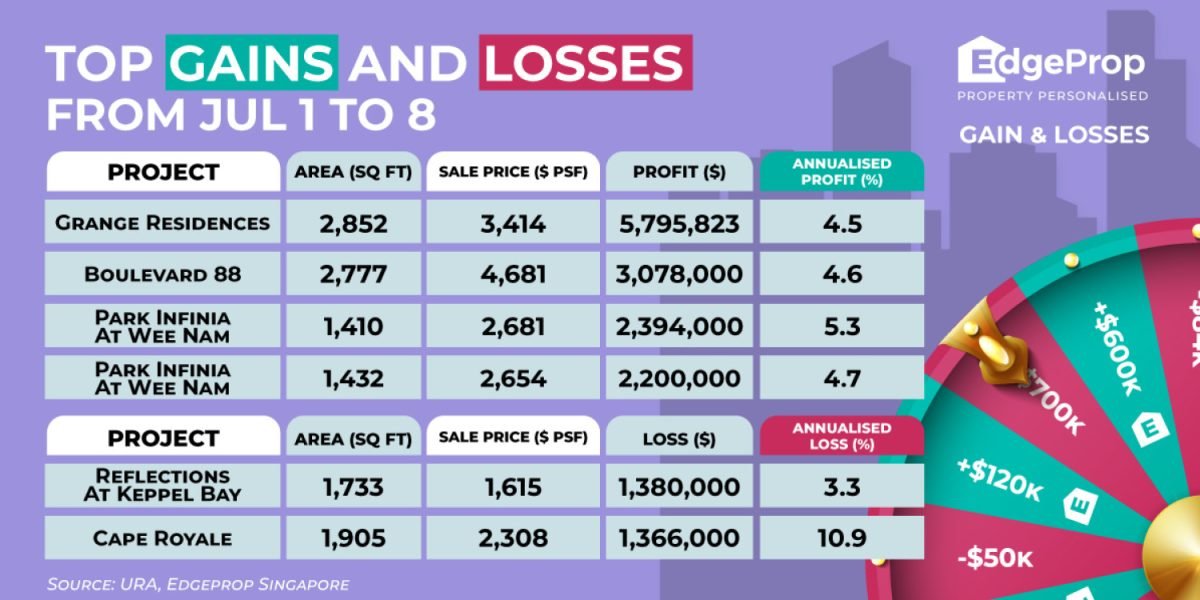

The sale of a four-bedroom unit at Grange Residences was the most profitable transaction during the week of July 1 to 8. The 2,852 sq ft unit on the 13th floor fetched $9.74 million ($3,414 psf) on July 3. The unit had previously been purchased for $3.94 million ($1,382 psf) in October 2004. As a result, the seller made a profit of around $5.8 million (147%), which translates to an annualised gain of 4.5% over nearly 21 years.

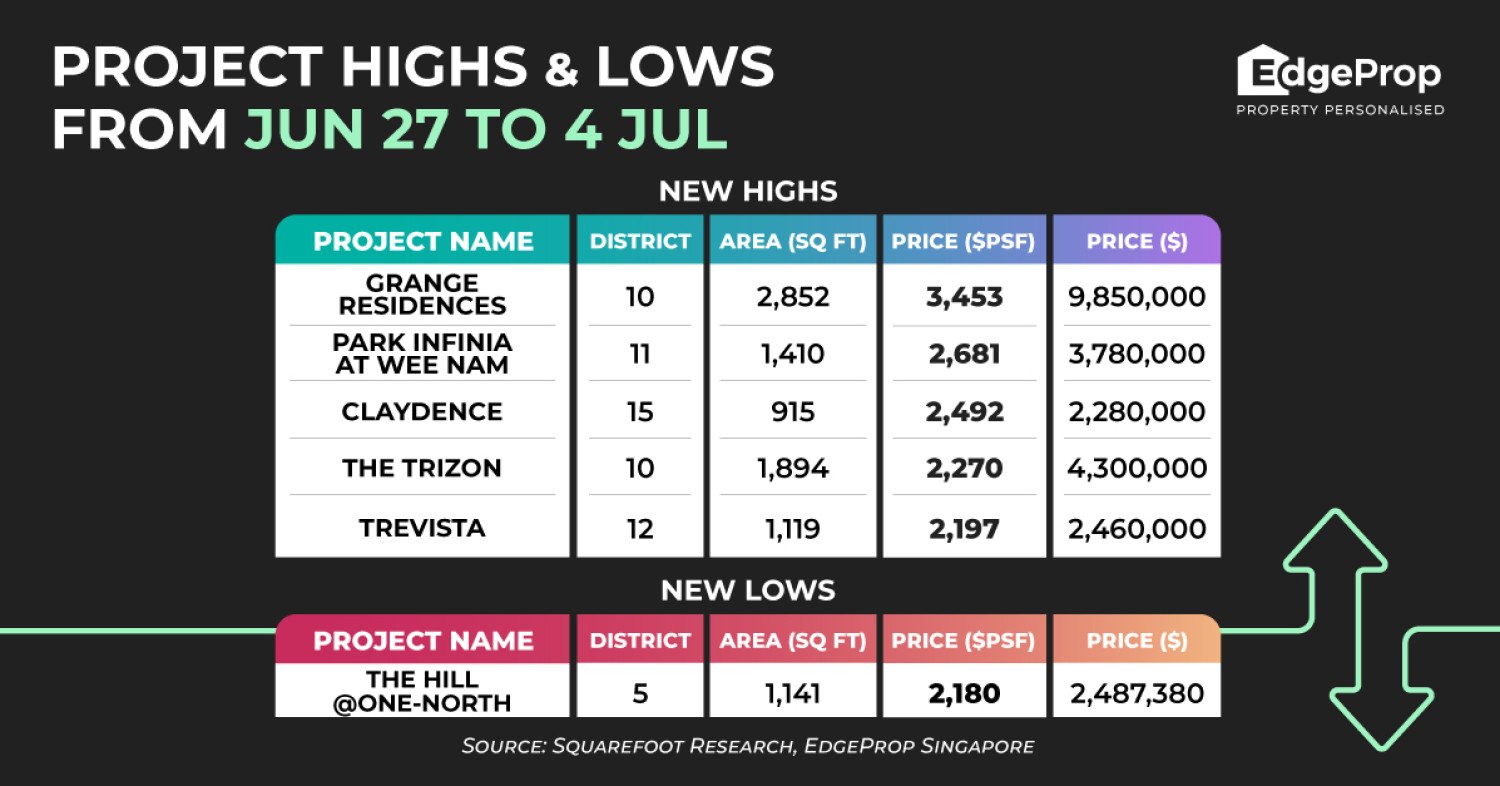

This marks the second most profitable resale transaction at Grange Residences to date. The highest gain was recorded from the sale of a similar four-bedroom unit on the fourth floor for $9.85 million ($3,453 psf) on June 30. The seller had purchased the apartment for around $3.35 million ($1,173 psf) in June 2004, realising a profit of $6.5 million or an annualised gain of 5.3% over more than 21 years.

A 2,852 sq ft unit at Grange Residences was sold for $9.74 million on July 3, netting a gain of $5.8 million. (Photo: Samuel Isaac Chua/The Edge Singapore)

Located along Grange Road in District 10, Grange Residences is a 164-unit development comprising three residential blocks that span 18 storeys. Completed in 2004, the development by Wharf Estates Singapore (formerly Wheelock Properties) offers only four-bedroom units of between 2,486 sq ft and 2,852 sq ft.

Besides the July 3 and June 30 transactions, the condo has seen one other resale transaction this year, which was also profitable. On Feb 26, another 2,852 sq ft unit transacted for $9.72 million ($3,408 psf), yielding the seller a $3.07 million profit after buying it in August 2009 for $6.65 million ($2,331 psf).

The second most profitable condo resale of the week was the sale of a 2,777 sq ft four-bedroom unit at Boulevard 88. The apartment was sold for $13 million ($4,681 psf) on July 4. Purchased in June 2019 for approximately $9.92 million ($3,573 psf), the seller raked in a gain of $3.08 million (31%) after six years of ownership.

This marks the fourth most profitable transaction at Boulevard 88 to date. The most profitable transaction at the development came from the sale of a 2,799 sq ft, four-bedroom apartment that changed hands for around $14 million in April 2023. The seller had purchased the 18th floor unit for $10.13 million in March 2019, raking in a profit of $3.87 million after owning the unit for over four years.

The sale of a 2,777 sq ft unit at Boulevard 88 was sold for $13 million on July 4, netting a gain of $3.08 million. (Photo: Samuel Isaac Chua/The Edge Singapore)

Located along Orchard Boulevard, Boulevard 88 is a freehold development in prime District 10. Completed in 2023, the 154-unit condo comprises a mix of two- to four-bedroom apartments spanning 1,313 sq ft to 6,049 sq ft. Nearby lifestyle hubs include Wheelock Place, Far East Shopping Centre, Ion Orchard and Shaw House.

In contrast, the least profitable transaction of the period in review involved a three-bedroom unit at Reflections at Keppel Bay. Sold for $2.8 million ($1,616 psf) on July 3, the 1,733 sq ft unit had been previously purchased for $4.18 million ($2,412 psf) in August 2013. As a result, the seller incurred a loss of $1.38 million (33%), or an annualised loss of 3.3% over nearly 12 years.

The record loss at the development came from the sale of a 7,050 sq ft duplex penthouse on the 40th floor, which was sold for around $11 million in September 2021. The unit had previously fetched $17.98 million ($2,550 psf) in May 2007, resulting in a record loss of $6.95 million or an annualised loss of 3.4% over more than 14 years.

A three-bedroom unit at Reflections at Keppel Bay fetched $2.8 million on July 3, resulting in a loss of $1.38 million. (Photo: Samuel Isaac Chua/The Edge Singapore)

Completed in 2011, Reflections at Keppel Bay is a 1,129-unit waterfront luxury development in prime District 9. The 99-year leasehold development comprises six residential towers housing between 24 and 41 storeys. The development also offers 11 low-rise villa apartment blocks. Units include one- to four-bedroom apartments spanning 732 sq ft to 2,874 sq ft, and penthouses of 3,488 sq ft to 12,900 sq ft.

To date, the development has seen 40 resale transactions this year, 18 of which are unprofitable, including the July 3 transaction. The units, measuring between 1,055 sq ft and 3,283 sq ft, were sold at losses of between $13,600 and around $1.37 million.