-EP1197.jpg?lCSz00IX29vzei.CxYh539C8eKasL2Mw&itok=HHz58tz-)

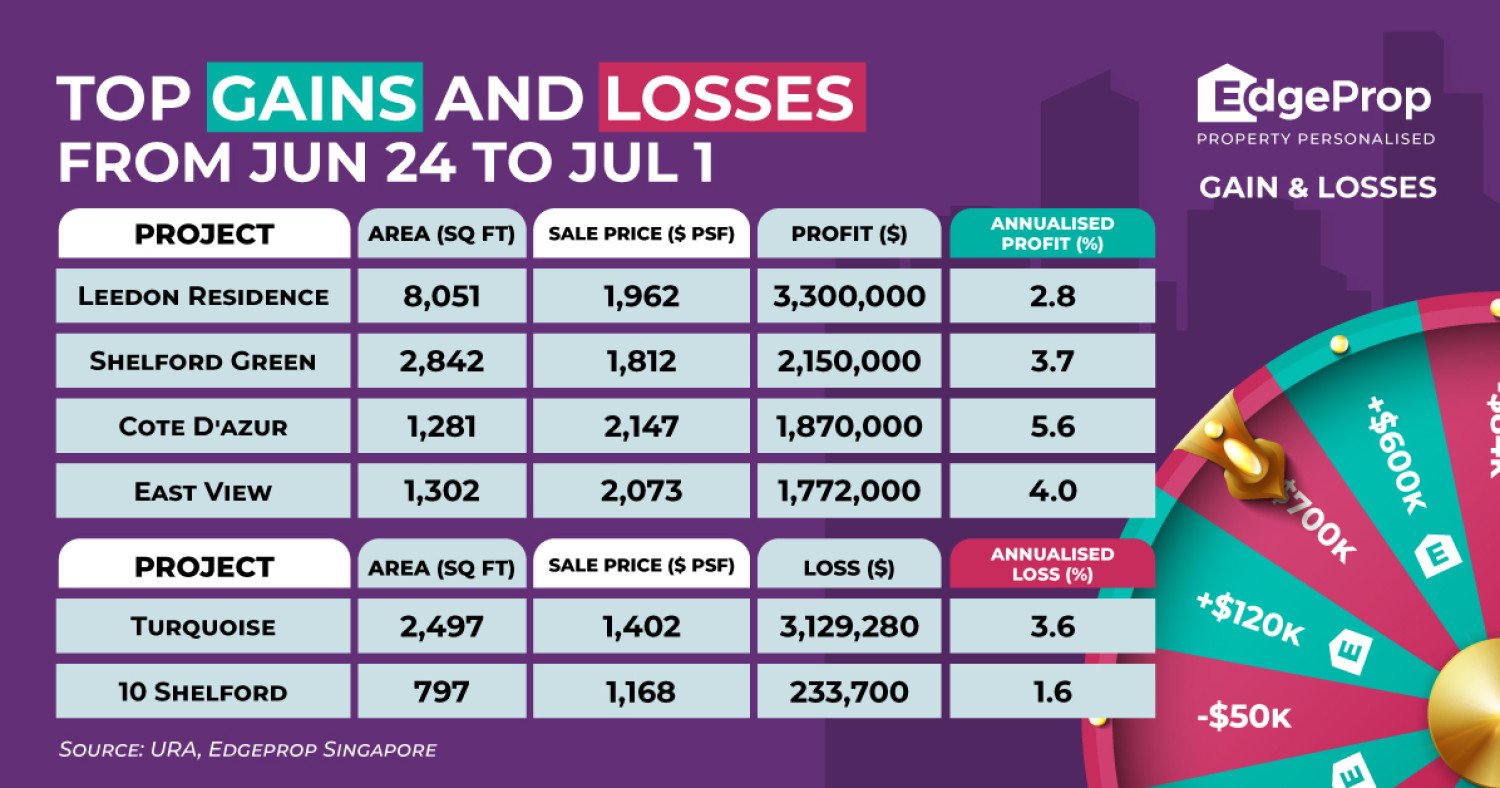

The sale of a five-bedroom unit at Leedon Residence was the most profitable transaction during the week of June 24 to July 1. The 8,051 sq ft unit on the first floor fetched $15.8 million ($1,962 psf) on June 30. The unit had been previously purchased for $12.5 million ($1,553 psf) in February 2017. Thus, the seller raked in a profit of $3.3 million (26.4%) or an annualised profit of 2.8% over more than eight years.

Based on lodged caveats, the transaction is the second most profitable deal to date at Leedon Residence. It is about $700,000 short of the development’s record gain of $4 million, which came from the sale of a 6,125 sq ft, five-bedroom apartment on the 11th floor for $16 million ($2,612 psf) on March 26. The seller, who purchased the unit for around $12 million ($1,959 psf), walked away with an annualised gain of 3.7% after holding the unit for almost eight years.

The 8,051 sq ft unit at Leedon Residence was sold for $15.8 million on June 30. (Photo: Samuel Isaac Chua/The Edge Singapore)

Completed in 2015, Leedon Residence is a freehold development along Leedon Heights in prime District 10. The development comprises 381 units spread across 12 residential blocks, which include a mix of two- to five-bedders ranging between 1,044 and 4,704 sq ft. The first floor of the development also has “garden suites” comprising three- to five-bedroom units spanning 3,789 to 8,051 sq ft, while the top floors house three- to five-bedroom penthouses of 3,283 to 7,718 sq ft.

Seven resale transactions have been recorded at the development this year, all of which were profitable, including the June 30 and March 26 transactions. The units were transacted at an average price of $2,456 psf.

The second most profitable resale during the week took place at Shelford Green. A 2,842 sq ft, three-bedroom unit on the third floor fetched $5.15 million ($1,812 psf) on June 30. The seller purchased the unit in October 2010 for around $3 million ($1,056 psf), netting a gain of $2.15 million (71.7%) after holding the unit for almost 15 years.

The deal marks the second-highest gain ever recorded for a unit at the development. The most significant gain made at Shelford Green came with the sale of a 3,735 sq ft, five-bedroom unit for $6.2 million ($1,660 psf) in April 2008. The unit had been bought for $1.9 million ($509 psf) in April 1998. Hence, the seller netted a profit of $4.3 million or an annualised gain of 12.5% over 10 years.

A three-bedroom unit at Shelford Green was sold for $5.15 million on June 30, netting a gain of $2.15 million. (Photo: Samuel Isaac Chua/The Edge Singapore)

Shelford Green is a freehold condo located along Shelford Road in District 11. Completed in 1982, the development comprises 33 units, including a mix of two- to five-bedroom units measuring 1,302 sq ft to 3,757 sq ft.

In contrast, the least profitable transaction during the week involved a 2,497 sq ft, four-bedroom unit at Turquoise. The fifth-floor unit changed hands for $3.5 million ($1,402 psf) on June 26. It had been purchased for $6.6 million ($2,655 psf) in October 2007. Hence, the seller incurred a loss of $3.13 million (47.2%), or an annualised loss of 3.6% over almost 18 years.

A 2,497 sq ft unit at Turquoise fetched $3.5 million on June 26, incurring a loss of $3.13 million. (Photo: Samuel Isaac Chua/The Edge Singapore)

Completed in 2010, Turquoise is one of a handful of 99-year leasehold condos in the exclusive Sentosa Cove residential enclave. The development comprises 91 units across three six-storey blocks with a mix of three- and four-bedroom apartments, which span from 2,088 sq ft to 3,050 sq ft. It also offers penthouses from 3,111 sq ft to 3,764 sq ft and sky villas from 6,900 sq ft to 7,987 sq ft.

The transaction is the seventh most unprofitable deal to date at the condominium. The record loss remains the sale of a 3,746 sq ft, five-bedroom penthouse unit for $4.4 million ($1,175 psf) in September 2018. It had been previously purchased for $9.53 million ($2,545 psf) in November 2007. Thus, the seller incurred a record $5.13 million loss, which translates to an annualised loss of 6.9% over 10 years.

![residential-transactions-with-contracts-dated-june-24-to-july-1-[done-deals]](https://www.thecollective-at-one-sophia.sg/wp-content/uploads/2025/07/23025-residential-transactions-with-contracts-dated-june-24-to-july-1-done-deals.jpg)