-EP1194.jpg?Hm48DbcqXhqYRLezkO59P9BDlU7xxM67&itok=78aTQwhl)

The sale of a four-bedroom unit at The Tessarina was the most profitable condo resale transaction during the week of June 3 to June 10. The 1,615 sq ft unit on the fourth floor fetched $3.81 million ($2,362 psf) on June 3. The seller purchased the unit in March 2003 for $1.42 million ($878 psf), which translates to a profit of $2.4 million. This works out to a capital gain of 168.9% or an annualised profit of 4.5% over a holding period of about 22 years.

Based on the caveats lodged, this is the most profitable resale transaction recorded at The Tessarina to date. It surpasses the previous record gain of $2.18 million from the sale of a 1,335 sq ft three-bedroom unit for $3.1 million ($2,323 psf) on May 5. The seller had previously purchased the sixth-floor unit for $919,815 ($689 psf) in November 2006.

A 1,615 sq ft unit at The Tessarina achieved a record gain of $2.4 million when it sold for $3.81 million on June 3. (Photo: Samuel Isaac Chua/The Edge Singapore)

Completed in 2003, The Tessarina is a freehold development on Wilby Road, just off Bukit Timah Road in District 10. It comprises 443 units and is an 11-minute walk from King Albert Park MRT Station on the Downtown Line. The development offers a mix of two- to four-bedroom units ranging from 926 sq ft to 3,671 sq ft.

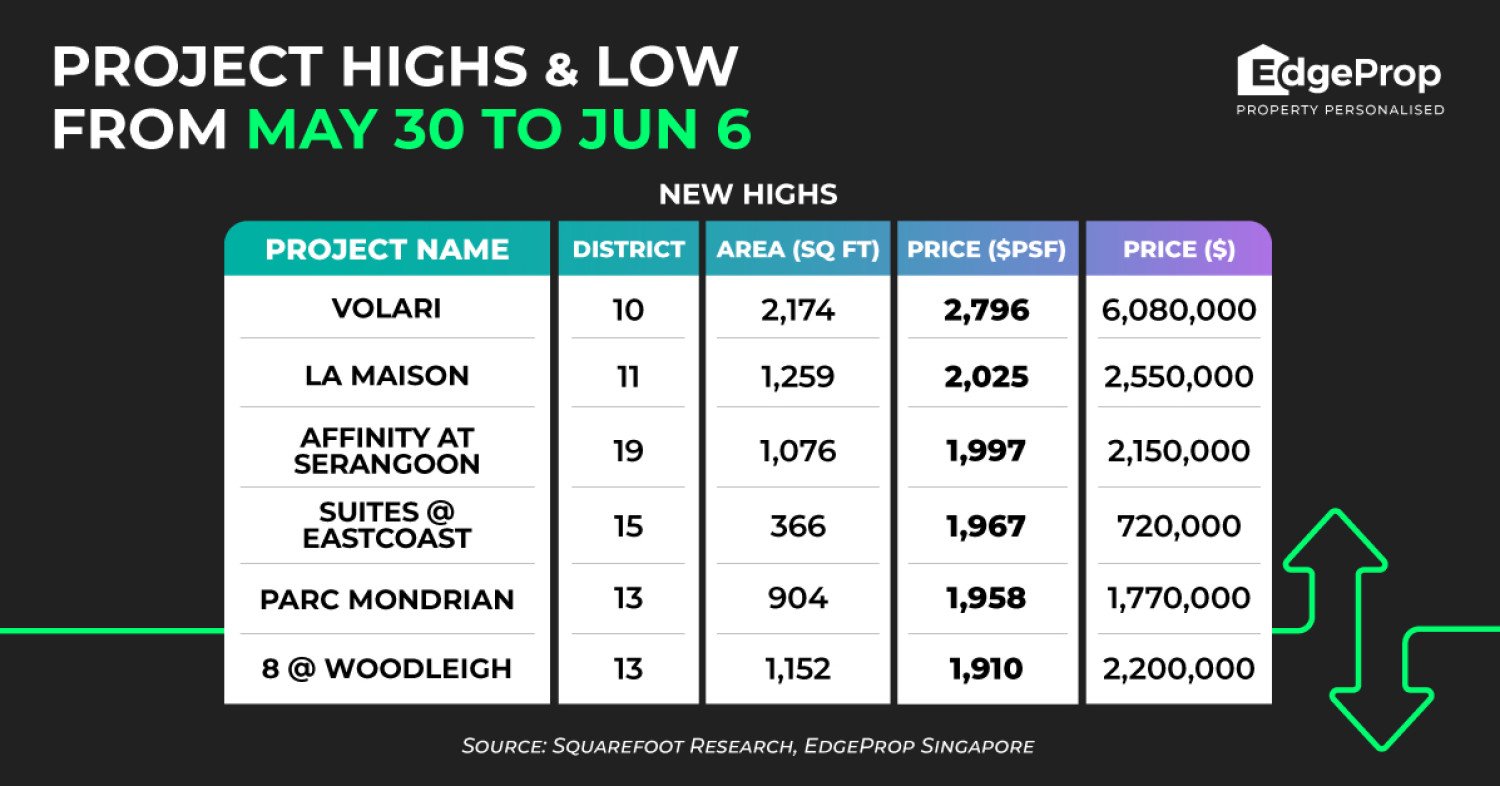

The second-most profitable resale of the week took place at Volari, a freehold condominium on Balmoral Road in prime District 10. A 2,174 sq ft unit on the fourth floor was sold for $6.08 million ($2,796 psf) on June 3. The four-bedroom unit had been bought for $4.24 million ($1,950 psf) in February 2017. This translated to a profit of $1.84 million (43.4%), or an annualised gain of 4.4% over a holding period of more than eight years.

This transaction marks a record profit at Volari. The previous high was set by a slightly larger 2,745 sq ft unit that sold for $6.2 million ($2,259 psf) in August 2010. The four-bedroom unit on the first floor had been purchased for $5.14 million ($1,874 psf) in August 2009, resulting in a profit of $1.06 million, or an annualised gain of 20.6% over one year.

A 2,174 sq ft four-bedroom unit at Volari was sold for $6.08 million on June 3, marking a gain of $1.84 million. (Photo: Samuel Isaac Chua/The Edge Singapore)

Completed in 2012, Volari is an 85-unit condo with a mix of two- to four-bedroom apartments, ranging from 1,324 sq ft to 2,745 sq ft. It also features three penthouse units, ranging from 3,950 sq ft to 6,168 sq ft. The development is within a four-minute walk of Balmoral Plaza and is close to the Anglo-Chinese School (Primary).

Based on caveats, there has been one other resale transaction at Volari, which was also profitable. This occurred from the sale of a similar 2,174 sq ft four-bedroom unit for $5.85 million ($2,690 psf) on March 13. The seller had previously purchased the ninth-floor unit for $5.44 million ($2,500 psf) in November 2012, which resulted in a profit of $415,000, or an annualised gain of 0.6% over more than 12 years.

In contrast, the most unprofitable deal of the week was the sale of a 635 sq ft unit at Scotts Square. The one-bedroom apartment on the 31st floor was sold for $1.9 million ($2,992 psf) on June 3. It had been bought for $2.62 million ($4,120 psf) in August 2007, resulting in a loss of $716,200 (27.4%) or an annualised loss of 1.8% over nearly 18 years.

Scotts Square is a freehold mixed-use development on Scotts Road in prime District 9, just off Orchard Road. Completed in 2011, it features 338 residential units across two towers set above a four-storey retail podium. The development offers one- to three-bedroom apartments ranging from 624 sq ft to 1,238 sq ft.

A one-bedroom apartment at Scotts Square was sold for $1.9 million on June 3, resulting in a loss of $716,200. (Photo: Samuel Isaac Chua/The Edge Singapore)

There have been four resale transactions at Scotts Square so far this year, two of which were unprofitable, including the June 3 transaction. The seller of a 947 sq ft two-bedder incurred the highest loss of $745,880 when the 28th-floor unit was sold for $3.08 million ($3,252 psf). The unit was previously purchased for $3.82 million ($4,039 psf) in December 2007.

The record loss at Scotts Square involved a 1,249 sq ft unit on the 36th floor, which was sold for $3.65 million ($2,923 psf) in February 2017. The unit had previously fetched $5.21 million ($4,171 psf) in August 2007. As a result, the seller incurred a record loss of $1.56 million or an annualised loss of 3.7% over nearly 10 years.